When looking for a job, you might think that you will become an employee, and when you work for a company, you may say that you are employed by that company . However, that is not always the case, for you may be hired as an independent contractor, especially in some lines of work. Due to this, it is important to know what makes an independent contractor different from an employee.

Employees

Employees are hired by a company to do work, just like independent contractors, but employees are different because the employer has complete control of their working schedule. Due to this, the Labor Code mandates that employees be given benefits.

Benefits of Employees

Employees are guaranteed an 8-hour working day for 5-6 days, with one day of rest. Also, they can have the following benefits:

- Company Insurance: If your employer has a company insurance plan, then you, as an employee are entitled to avail of it. However, it lasts only until you cease to be an employee of your company, so be sure that you have your own insurance plan, just to be safe.

- SSS and PhilHealth Contributions and Income Taxes are Withheld by Your Employer: The law mandates that SSS (pension), PhilHealth (for state healthcare) and your income taxes as an employee are withheld by your employer. This is a perk because you don’t have to worry about your taxes and other mandatory contributions

Disadvantages of Being an Employee

However, being an employee also has its disadvantages:

- The Employer Has Full Control of Your Time: In return for your employee benefits, the employer has full control of your 8 hours, so you have to report to work and do your job during these 8 hours. In fact, you can be required to work on holidays, but you get extra pay.

- Harder to Leave: Leaving your job is harder if you are an employee, since you have to give an advance notice. Also, there is a process to follow.

Independent Contractors

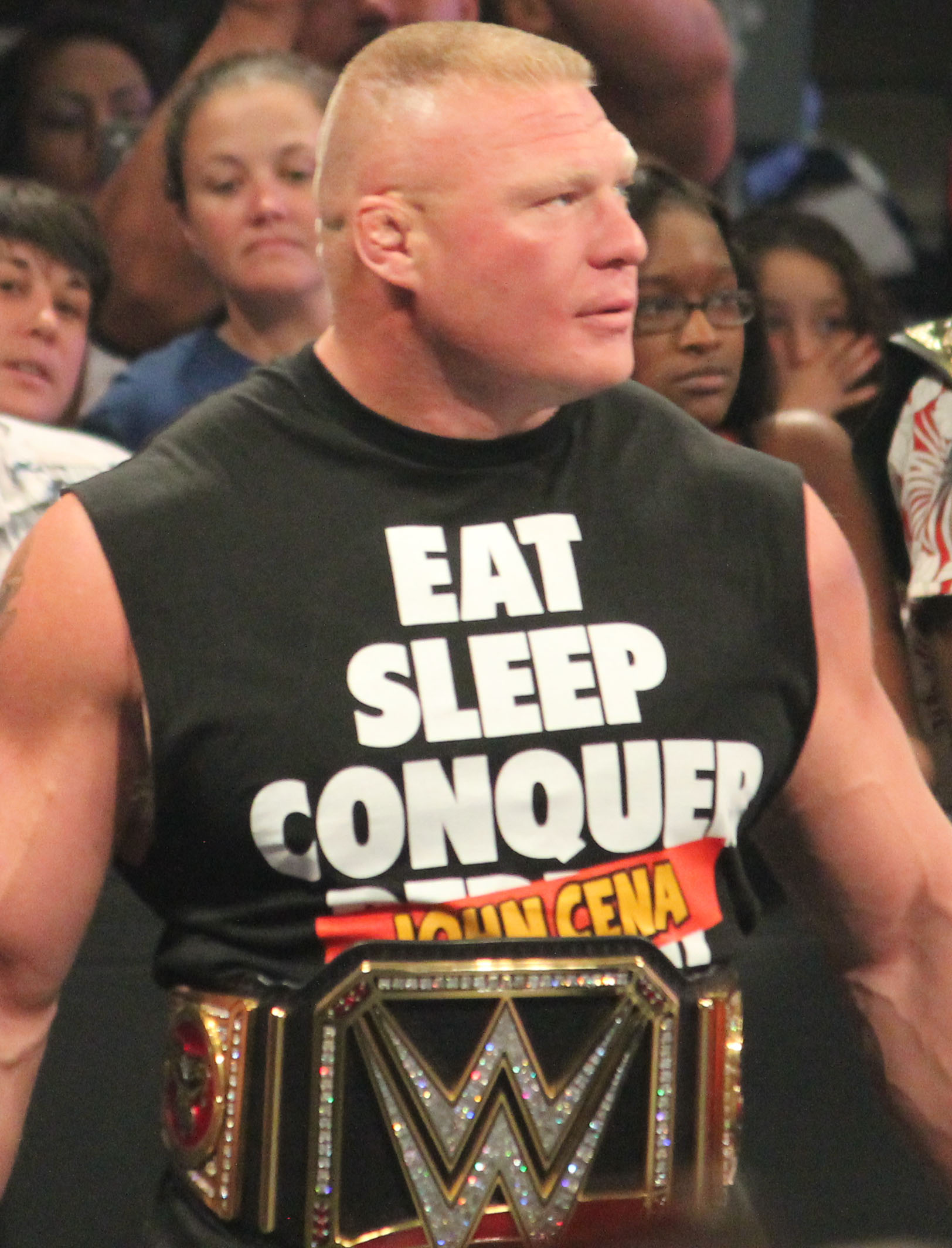

Independent contractors are contracted to perform services, just like employees. However, what sets them apart is that there is no employer-employee relationship between an independent contractor and the company. Examples of independent contractors include professional athletes and freelancers.

Benefits of Being an Independent Contractor

Since there is no employer-employee relationship, the independent contractor has the following perks:

- The Independent Contractor Has More Control of His/Her Time: Due to the lack of an employer-employee relationship, the independent contractor normally has more control over his/her time, provided the job is completed as scheduled.

- Independent Contractors Can Have Multiple Employers: Due to the self-employed status of an independent contractor, an independent contractor can have multiple employers. This is good because contractors can build their clout and gain experience by working for multiple companies at once.

- It Can be Easier to Leave: As an independent contractor, if you are feeling burnt out, then you can simply ask for a release from your contract.

Disadvantages of Being an Independent Contractor

Despite these advantages, being an independent contractor has its pitfalls:

- Being Responsible for Mandatory Contributions and Taxes: Since independent contractors are classified as self-employed, they are responsible for paying their SSS and PhilHealth contribution, as well as their income taxes. Thus, they have to file their own tax returns, which can be a hassle.

- Misclassification: Some employers can abuse the status of an independent contractor by using it as an excuse to deny employees benefits. This happens when employers make employees sign contracts stating that there is no employer-employee relationship, yet they still maintain full control of work hours.

It is Important to Know, to Prevent Problems

In the end, it is important to know the differences of employee status from that of an independent contractor, in order for you, job applicants, to protect yourselves from abuse. Also, it is up to you if you want the security of an employee, or the freedom of an independent contractor. Just make sure you read your contract first, OK?