For the living, the only thing that is certain other than change is paying taxes. Taxes are collected by the government to pay its employees, build projects, and improve the lives of its citizens. This is why every worker earning more than 250,000 pesos is required to pay income tax. So, since income tax is a fact of life for wage earners and the self-employed, here are some things to remember when paying your income tax.

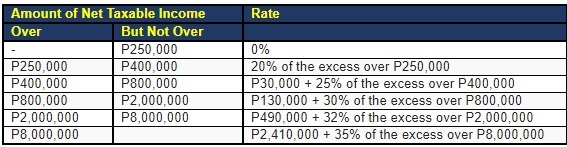

File the Right Form

When filing your income tax returns, it is important that you file the proper form, to prevent any problems with the Bureau of Internal Revenue. For example, freelancers have to file BIR Form 1701A, and people with multiple employers need to file BIR Form 1701. However, most employees do not need to file their tax returns since employers file these for them. After all, employers are responsible for withholding their employees’ taxes. But, if you have multiple income streams, you must file your own taxes, so please use the right form.

Learn to Calculate Your Taxes

Even if you can hire an accountant to do your taxes for you, it is still important to know how to calculate your taxes. This is to ensure that your accountant won’t take advantage of you, and since accountants are only human, they make mistakes too. If you know how to calculate your taxes, then you can correct your accountant if necessary. Also, employees should know how to calculate their taxes, so they can be sure that the right amount is being withheld by their employers.

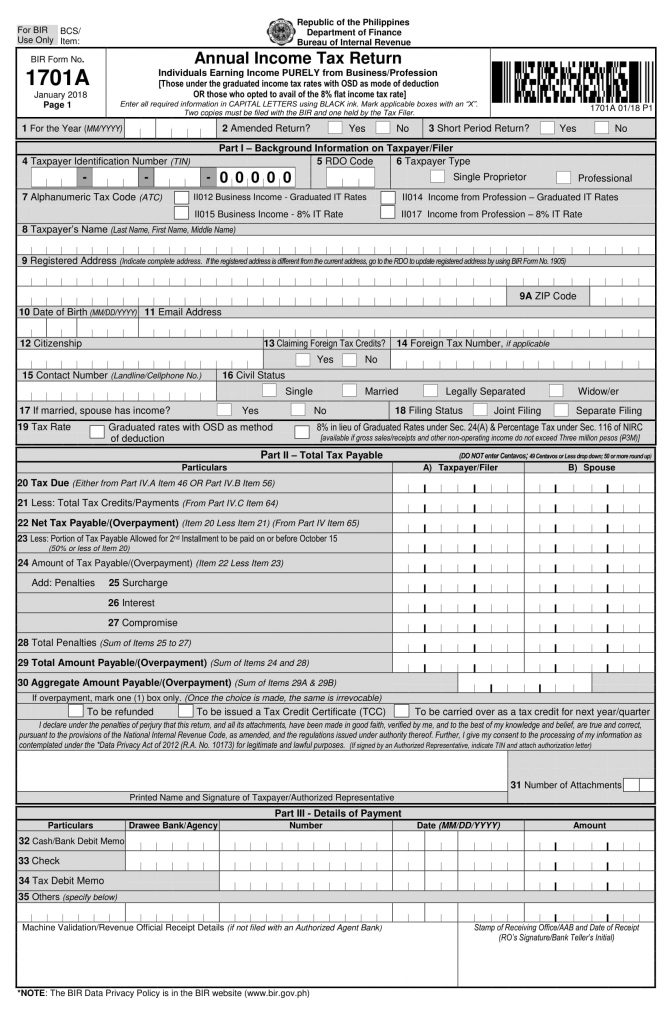

Also, it is very simple to calculate your taxes, as long as you know your annual income, and have a passable knowledge of algebra. All you need to do is follow this table, and your tax calculation needs will be met.

Don’t Hide Anything from the BIR

If you are a freelancer, then you are considered self-employed, so this means that you are solely responsible for filing your tax returns. So, when filling the form, you must declare all your income. If you don’t, then you will be guilty of tax evasion, which is a crime. This is because you will end up defrauding the whole Philippines, for your undeclared taxable income could have been used to develop the country.

FOR CORPORATE TAXPAYERS: Please withhold the right amount from your employees, to prevent issues with the law. Also, please don’t classify workers as independent contractors just to escape your obligations towards them, like withholding their taxes. Independent contractors file their own taxes due to their independence, but if they lack that independence, it is technically illegal misclassification.

Remember Why You Pay Taxes

If you feel burnt out when filing your taxes, or simply disillusioned because of all the government scandals, what you need to remember when paying your taxes is that it is your way of showing your love for your country. Remember, your country is your home, where you were born and raised. Since your country has done so much for you, it is important to remember to do your part for your country. Remember, there are many hardworking government employees and officials, so we must pay our taxes to support them. Also, in the end, you will benefit from the projects of the government, since these include better roads, efficient public transport, and a more peaceful country. So, it can be said that the money you shell out for your income tax will return to you one day.

Sources: https://www.taxumo.com/blog/updated-bir-forms-2019/

https://www.bir.gov.ph/index.php/tax-information/income-tax.html